In the dynamic landscape of the Greater Toronto Area (GTA), where soaring skyscrapers intermingle with cozy suburban neighborhoods, one factor stands as a cornerstone of homeownership dreams is mortgage rates. Whether you’re a first-time buyer or a seasoned homeowner, understanding mortgage rates is key to making informed decisions in the GTA’s bustling real estate market.

In this blog, we’ll break down the basics of mortgage rates, explore current trends, and empower you with the knowledge needed to navigate the GTA’s housing landscape effectively. Let’s dive in!

Section 1: Understanding Mortgage Rates

Mortgage rates are the interest rates you pay on your home loan, determining how much you’ll repay each month.

Here’s what influences them:

- Bank of Canada’s Interest Rate: The Bank of Canada sets a key interest rate, affecting borrowing costs. When it changes, mortgage rates can follow suit.

- Economic Indicators: Factors like employment rates and inflation impact mortgage rates. A strong economy usually means lower rates, while uncertainty can drive them up.

- Lender Policies: Each lender sets its own rates based on factors like their costs and competition. So, rates may vary between lenders.

Other Influences:

- Government Policies: Rules like stress tests and housing interventions can affect rates by changing how lenders assess risk.

- Global Economy: Events worldwide can influence rates indirectly by affecting financial markets and investor confidence.

- Market Demand: When lots of people want mortgages, rates may rise as lenders manage their loans.

Section 2: Current Mortgage Rate Trends in the GTA

Right now, in the Greater Toronto Area (GTA), mortgage rates are fairly stable. Here’s a quick look at what’s happening with both fixed-rate and variable-rate mortgages:

Fixed-Rate Mortgages: These mortgages offer stability because your interest rate stays the same for a set period, usually one to five years or more. In the GTA, the average fixed-rate mortgage is around 4.79% for a 5-year term.

Variable-Rate Mortgages: These mortgages are tied to the lender’s prime rate, so they can change over time. Recently, variable-rate mortgages in the GTA have been competitive, offering lower initial rates. Right now, the average variable-rate mortgage in the GTA is approximately 5.95% for a 5-year term.

Section 3: Factors Influencing Mortgage Rates in the GTA

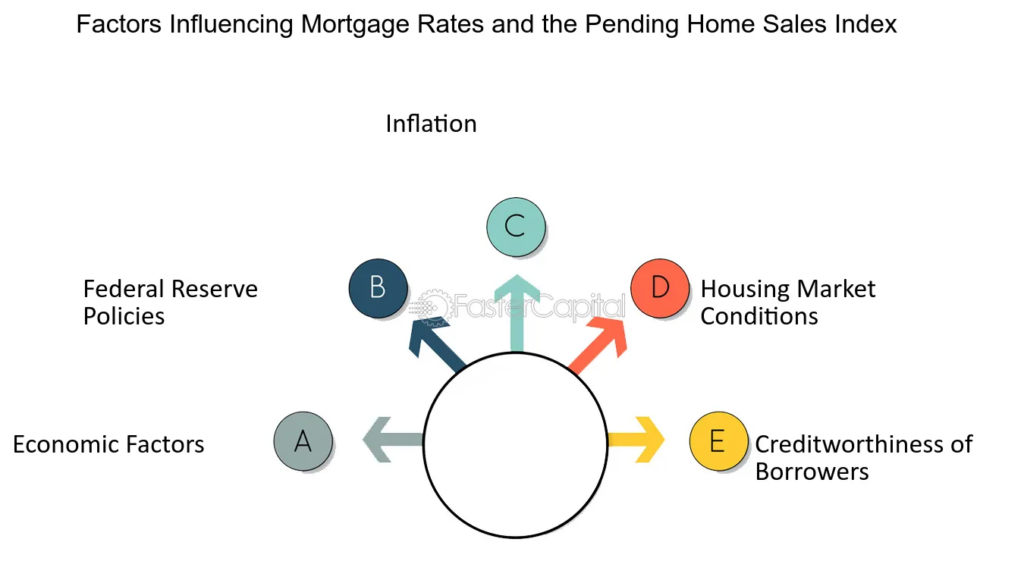

In the Greater Toronto Area (GTA), several factors affect mortgage rates:

- Demand for Housing: High demand can lead to higher rates, while lower demand may result in more competitive rates.

- Employment Trends: Low unemployment and a strong job market typically correlate with lower mortgage rates.

- Government Policies: Regulations like mortgage stress tests can impact lender practices and influence rates.

- Local Economic Conditions: Economic growth, inflation, and consumer confidence in the GTA can influence rates.

- Global Economic Factors: Changes in global markets, central bank policies, and geopolitical events can also affect rates.

- Housing Market Dynamics: Trends like inventory levels and home prices in the GTA can influence borrowing costs.

- Central Bank Policies: Decisions by the Bank of Canada, such as changes to the key interest rate, directly impact mortgage rates.

Understanding these factors helps borrowers make informed decisions when navigating the GTA’s housing market.

Section 4: Tips for Securing the Best Mortgage Rate

- Boost Your Credit Score: Improve your credit score by paying bills on time and reducing debt.

- Shop Around: Compare rates from different lenders to find the best deal.

- Know Your Options: Understand the types of mortgages available and choose one that fits your needs.

- Consider Term Length: Shorter terms often mean lower rates but higher payments.

- Negotiate: Don’t hesitate to negotiate with lenders for better rates or terms.

- Account for Additional Costs: Factor in fees and other expenses when comparing rates.

- Get Pre-Approved: Being pre-approved can give you an advantage when house hunting.

- Stay Updated: Keep an eye on market trends and be flexible to take advantage of favourable rates.

Following these tips can help you secure the best mortgage rate for your home purchase in the GTA.

Section 5: Case Studies or Expert Insights

Case Studies: These are examples that showcase different scenarios and solutions related to mortgages, offering valuable insights into how various situations can be approached and resolved.

Expert Insights: These are pieces of advice and recommendations provided by professionals who have extensive knowledge and experience in the mortgage industry.

Conclusion:

In the blog, we covered mortgage rates in the GTA, including what they are, how they’re determined, and practical tips for getting the best rate. We emphasized the importance of staying informed about mortgage rates in the GTA to make informed decisions. We encouraged readers to keep researching and seek professional guidance when needed.

For further details or assistance with the real estate in the GTA, feel free to contact

Paul Bendavid

RE/MAX Realtron Realty Inc. Brokerage

Cell: 647-988-7355

Office: +1 905 539 9511

Address: 183 Willowdale Ave, Toronto, Canada